Democratic Sen. Ron Wyden is drawing up a surtax on Big Oil that seeks to restrain the industry’s skyrocketing profit margins at a time when gasoline prices are at record highs.

Wyden, an Oregon Democrat who seats the Senate Finance Committee, is drifting a 21% surtax on the overabundance benefits of oil and gas organizations that create more than $1 billion in income, as per a representative for the congressperson.

“Our wrecked duty code is working for Big Oil, not American families,” Wyden told CNN in a proclamation.

The proposition, revealed prior by Bloomberg News, likewise requires a 25% extract charge on stock buybacks and would close a bookkeeping proviso on inventories that pundits say permits oil organizations to downplay their benefits and concede burdens endlessly.

“The proposition I’m creating would assist with switching unreasonable motivating forces to cost gouge by multiplying the corporate assessment rate on organizations’ abundance benefits, killing appalling buybacks, and lessening bookkeeping stunts,” Wyden said.

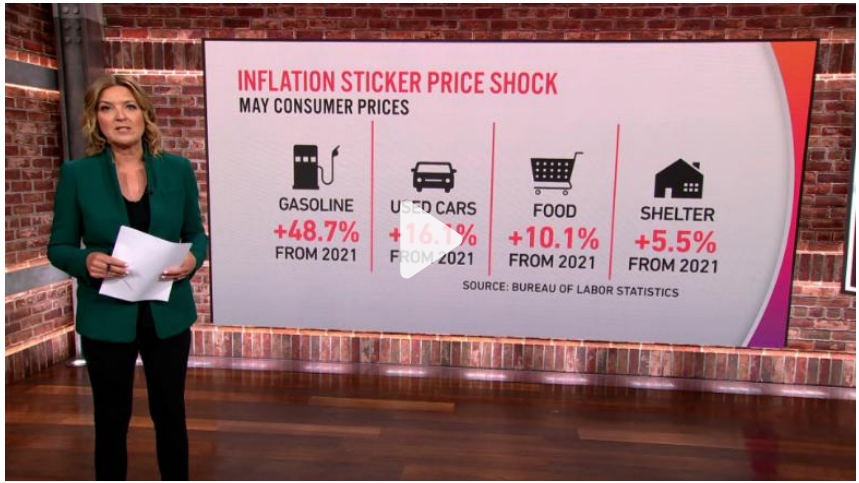

Such a move could be well known given that oil organization benefits are flooding, and fuel costs are at record highs.

Nonetheless, there is a gamble that impressive an extra duty on the oil business would blow up by discouraging venture when organizations need to spend more on costly new penetrating undertakings to stay aware of interest.

“Policymakers ought to be centered around expanding energy supply and decreasing expenses for Americans,” Frank Macchiarola, senior VP of strategy, financial matters and administrative undertakings at the American Petroleum Institute, said in a proclamation. “Forcing new expenses on our industry will do the specific inverse and possibly deter venture when it’s required most.”

It’s not satisfactory if the White House could uphold the additional charge drifted by Wyden. The White House didn’t quickly answer a solicitation for input.

Be that as it may, last week a White House official impacted “silly” oil organization benefits in a meeting with CNN and left the entryway open to supporting a bonus benefit charge.

President Joe Biden turned up the manner of speaking against the oil business on Friday, calling out ExxonMobil specifically.

“Exxon got more cash-flow than God last year,” Biden said.

A Wyden representative said the congressperson’s oil overcharge stands apart from comparative bonus benefit charges presented in Congress since it would apply the duty in light of overall revenues, not oil costs.

In particular, it would apply a 21% extra duty on overabundance benefits. The proposition would work out overabundance benefits by deducting an ordinary return of 10% on costs from current benefits. Just organizations that produce overabundance benefits, under this proposition, would be expected to cover the duty.